Mercury Bank Review - no SSN business bank account in the US

John Thorstensen

John is a recognized world expert in investing. He has tested dozens of investment clubs, communities and investment research services. His research has been featured on Bloomberg, Business Insider, The New York Times, Wall Street Journal, CNet and more.

🕒 Short on time?

It requires no minimum opening deposits, balances, and all transactions at low fees, making it very attractive for small businesses.

Mercury application is super easy, fast, and can be done entirely online. However, before applying for a business bank account, you must register your company in the United States and have an EIN (Employer Identification Number).

Register now to receive $50 for free when you spend $1000 with your Mercury debit card within 90 days!

- Money-free sign-up!

(8,848 user reviews)

Content

Mercury Bank Review

Mercury is a neobank built for startups that do business in the US. The fintech has disrupted traditional banking systems with an easy and revolutionary way to manage finance online and with less bureaucracy.

Mercury’s features have attracted foreign entrepreneurs who want a business banking platform with no transaction fees. The financial service also offers ‘Mercury Tea Room’ benefits for accounts that hold more than $250.000.

Mercury Bank Pros & Cons

Pros

- No monthly or transaction fees

- No minimum opening deposit

- No SSN required, foreigner-friendly

- 100% online account opening

- Internet-based banking services

- Robust security for businesses

- Associated debit card

- Unlimited amount of virtual debit cards

Cons

- Don’t accept cash deposits

- Not available for sole proprietors

Mercury at a glance

Foreign entrepreneurs who want to open a business bank account in the US may face some difficulties with traditional financial institutions due to excess bureaucracy and outdated policies, like requesting non-residents to bring documents in person to the bank branch.

Luckily, fintech companies are making the process simpler and fully online. Now, it’s possible to open an application for a U.S. business bank account overseas, in just a few minutes using Mercury, a neobank launched in 2019 to serve startups and small businesses.

The online banking platform provides checking and savings accounts to help startups manage their capital and scalable digital tools for a customized experience. Ideal for non-US citizen entrepreneurs, the free bank account is revolutionary in the US financial business.

It requires no minimum opening deposits, balances, and all transactions at low fees, making it very attractive for small businesses.

| Feature | Details |

|---|---|

| Account Types | Checking and savings |

| Minimum Deposit | $0 |

| APY (Annual Percentage Yield) | Up to 0.07% |

| Monthly Fee | $0 |

| Overdraft Fee | $0 |

| Wire Transfer Fee | $5 Domestic $20 International (Free when you reach $250.000 in deposits) |

| Sending & Receiving ACH Fee | $0 |

| Tea Room Account Minimum | $250.000 |

| Branches | - |

| ATM withdraw | Access to over 55,000 fee-free ATMs |

Is Mercury a bank?

Banking has evolved significantly over the past few years. Even though Mercury is not considered a bank - in the strict understanding of the term -, neither has local branches, the fintech provides the main banking services empowered by Evolve Bank & Trust.

Moreover, Mercury has robust banking security for business. The accounts are FDIC-insured with up to $250.000, the web pages are heavily encrypted, and a 2-factor-authentication is required.

Mercury is a tech-focused bank built mainly for startups, so banking services are not available for sole proprietors.

Accounts with over $250.000 in deposits automatically upgrade to the Mercury Tea Room. The benefits include having the extra funds invested into low-risk U.S. government securities, free domestic and international wire transfers, partner perks, and free tea (literally).

It’s clear that Mercury is a trustable neobank that cares about users' privacy and security. According to Crunchbase, the tech-focused bank raised $52.2M in funding over 4 rounds. The company conveys credibility as it was created by startup entrepreneurs and for startup entrepreneurs.

How to open an account

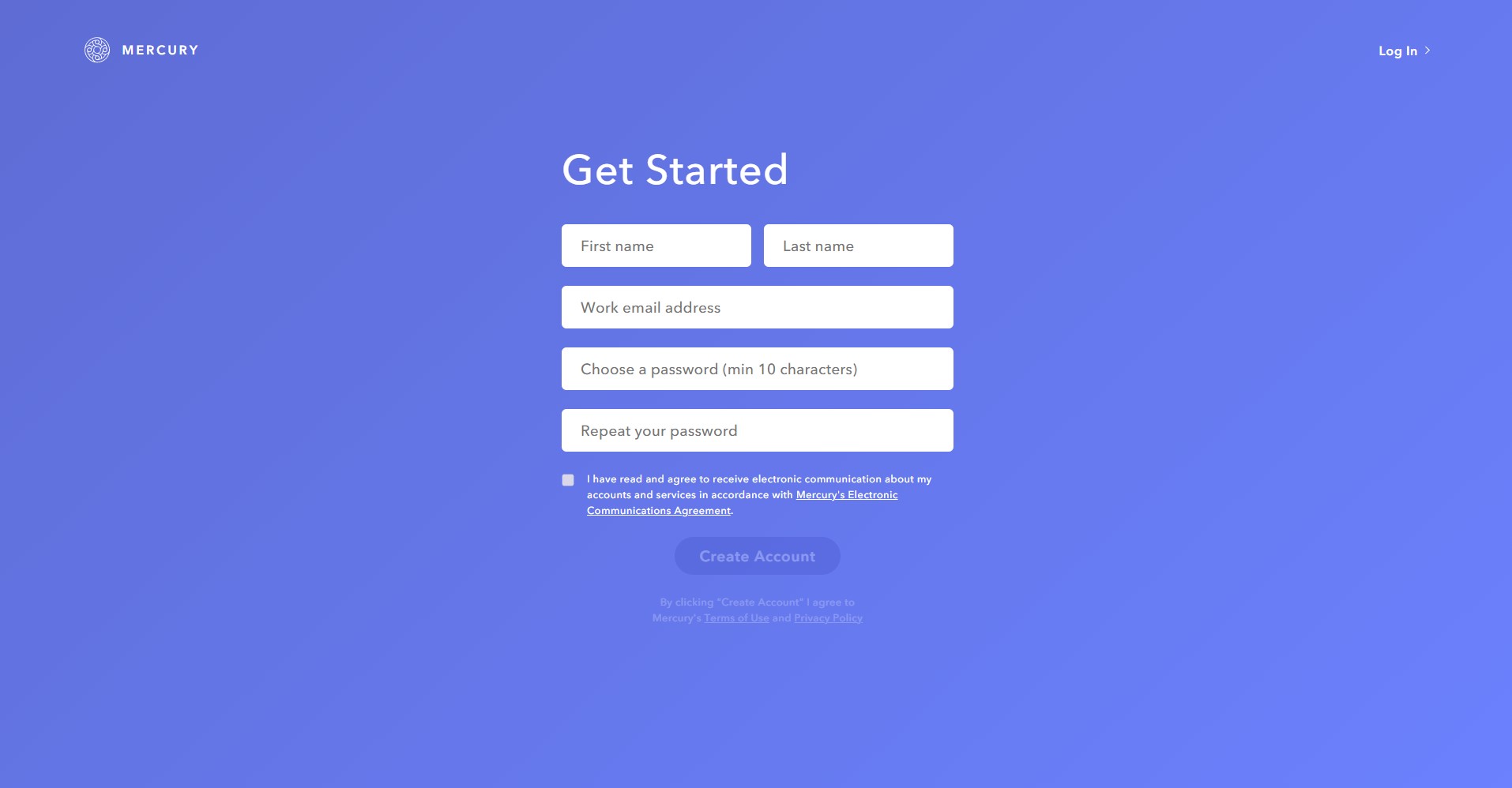

Mercury application is super easy, fast, and can be done entirely online. However, before applying for a business bank account, you must register your company in the United States and have an EIN (Employer Identification Number). This rule applies to any business bank account you want to open in a U.S. bank.

After completely registering your company in the US, you’re able to proceed with the account opening, providing the following documents online:

- Company formation documents

- EIN verification letter

- Social Security Number - SSN (not needed for foreigners)

- Official ID or Passport

Mercury doesn’t demand a minimum deposit to open a bank account. Additionally, if you don't have a business address in the United States, they let you use your registered agent's one.

What does it offer?

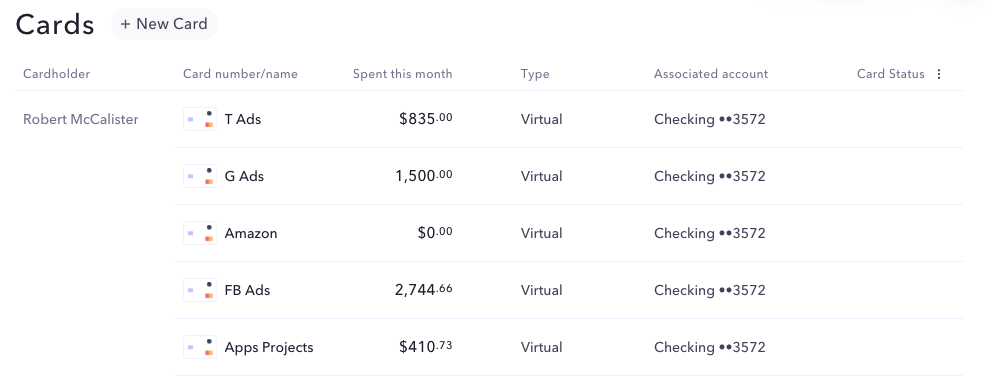

Once your account is approved, you’re able to fund your account, send payments, manage your transactions and spending through the website or the mobile app (only available for iOS). You’ll also receive a physical business debit card, and will be able to generate up to 50 virtual cards.

The instant creation of virtual debit cards is one of the most exciting features of Mercury, especially for online businesses that need to track different costs under 1 bank account. Moreover, it's possible to create different names for the virtual cards for easy navigation.

One of the biggest advantages that makes Mercury the best online U.S. bank account for non-resident aliens is the low fee. You don’t need to pay monthly, overdraft, or other hidden fees.

Basically, you just pay affordable fees for wire transfers: $5 for domestic and $20 for international. Tea Room (deposits with over $250.000) customers don’t pay for domestic and international wire transfers.

Languages

EN

Domestic Wire Fee

$5 (Free when you have $250.000 in deposits)

Signup Fee

$0

Reviews

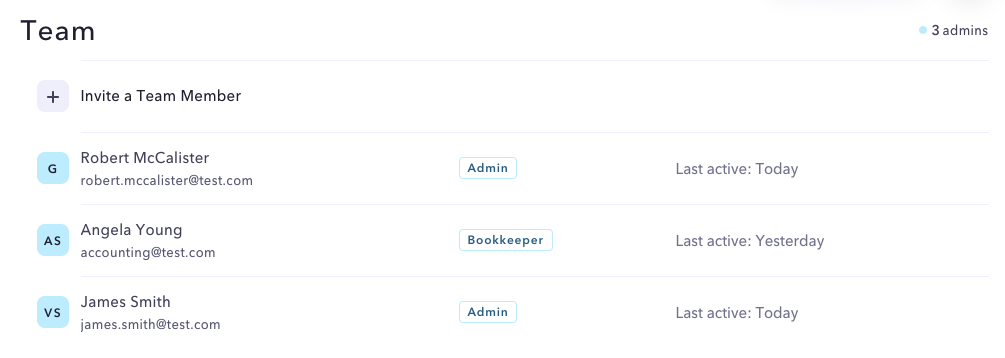

Entrepreneurs can open their business accounts and share financial responsibility among team members with two permission levels: administrator or bookkeeper. It’s also possible to have up to 14 sub-accounts, each with its own individual information and virtual cards.

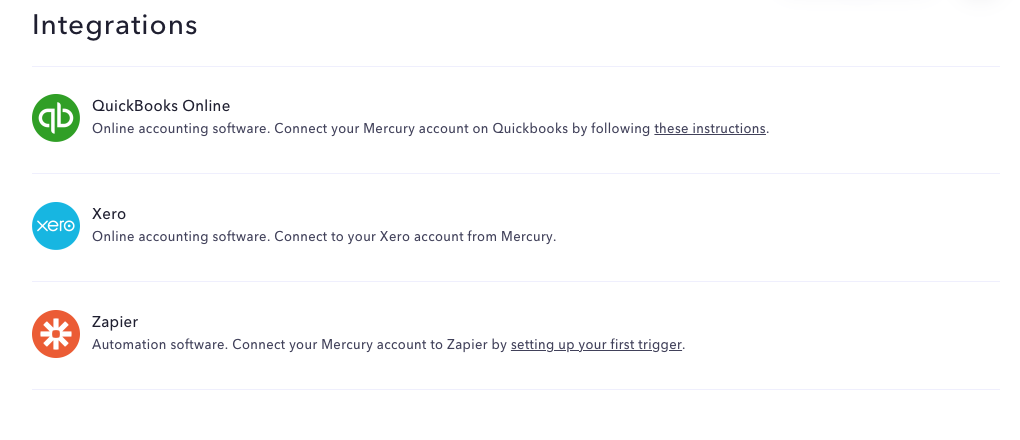

Mercury’s business account supports sending and depositing checks online, and also sending money electronically for free. The company also offers integrations with QuickBooks, Xero and Zapier.

It also can connect to any payment processor.

Summary - Make the most of Mercury

If you’re a non-US citizen entrepreneur and want to establish your business in the world’s largest economy, a Mercury account is ideal for handling USD finances at low fee rates and receiving payments within the United States.

However, international companies should also consider having a multi-currency account borderless account. In this case, Wise (formerly TransferWise) is the best option, as it provides the lowest market currency conversion rates and super-fast cross-border transfers.

By combining those two accounts, you’ll be able to manage your business account completely online, free of charge and with the best currency conversion rate on the market. Plus, you’ll be able to avoid the tons of papers and bureaucracy of traditional banks.

- No-fee sign-up!

About the author

John Thorstensen

John is a recognized world expert in investing. He has tested dozens of investment clubs, communities and investment research services. His research has been featured on Bloomberg, Business Insider, The New York Times, Wall Street Journal, CNet and more.